Biggest Mistakes People Make When Managing Their Monthly Bills

Managing bills can be a hassle. Especially, if you have ten or 12 bills to deal with. If you miss a payment, you could deal with late fees, higher interest rates and dings on your credit report.

Managing bills can be a hassle. Especially, if you have ten or 12 bills to deal with. If you miss a payment, you could deal with late fees, higher interest rates and dings on your credit report. However, it is not that difficult to manage your monthly bills. You simply have to avoid common mistakes that people make with their monthly bills. Here’s a look at the five biggest bill management mistakes and how you can avoid them.

- Not having a budget

One of the biggest mistakes that you can make is not setting a budget in the first place. When you set a budget, you allocate where all of your money is going to go. However, too many people forget about certain bills and then they don’t have enough money at the end of the month.

One of the best ways to set a budget is to use one of the popular budget and financing apps that are available on the iOS and Android stores. Here is a look at some of the most popular free budgeting apps available:

- Mint

- Personal Capital

- Pocket Guard

- YNAB

- Simple - Not knowing when bills are due

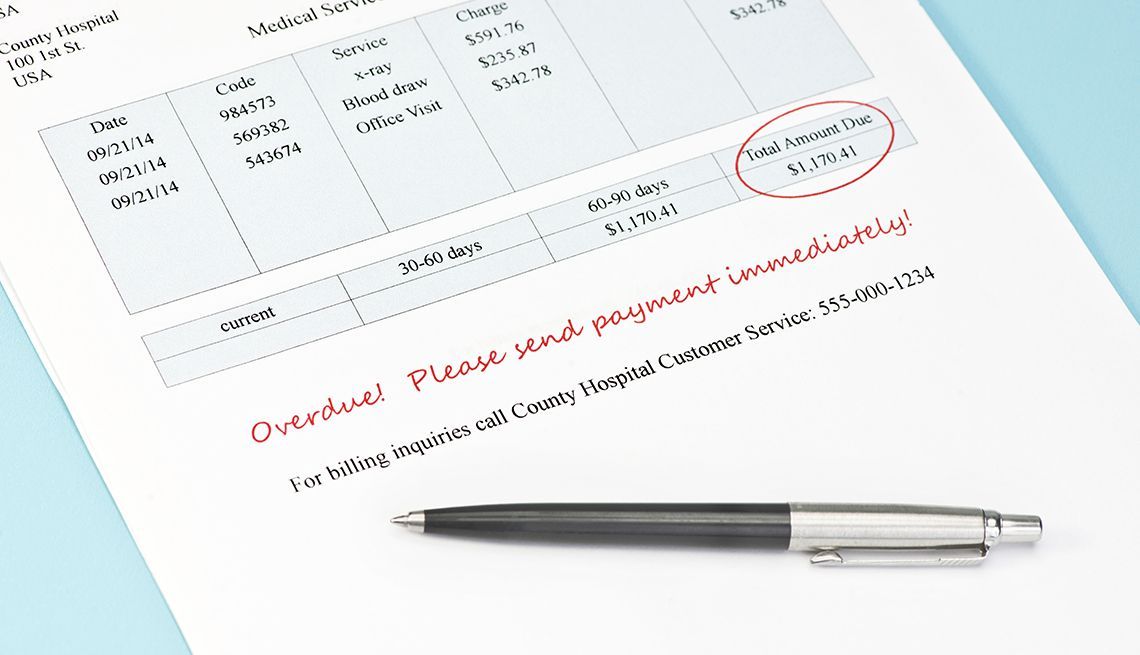

Another big mistake that many people make is simply not knowing when their bills are due. If you forget when your bills are due, you can end up losing more money than you’d expect. That’s because just about all past due bills come with late fees.

If you miss paying a utility bill, you can end up having a service deactivated. Then, you will have to pay a reactivation fee in order to pay back your service.

Now, let’s talk about credit cards. You certainly don’t want to miss your payments on all of your cards. Not only do you have to deal with late fees, you can find that your interest rates get hiked to a ridiculous rate.

Be sure to set an alert on your smartphone device warning you when your bills are due. That alone can save you some major headaches. - Not paying off bills when you have the funds

Look, no one wants to pay their bills. However, you don’t want to hold off on paying off all of your bills each month when you have the money. That’s because your bills can add up over time if you don’t completely pay them off.

Also, consider the fact that you will have to pay interest on the balance on your credit cards. This could add up to hundreds or even thousands of dollars in interest only payments per year.

Finally, when you pay off your bills each month, you have one less thing to worry about in your life. - Not setting up automatic payments

One great way to manage your bills is to set up automatic payments. Sadly, most people don’t take advantage of this convenience.

Once you have set up your budget, go ahead and set up automatic payments for your bills. This will allow you to pay off your bills without remembering all of them. Also, setting up automatic payments will help you keep a budget.

As you get older, your financial life will get more complex. Chances are, you will find yourself having to pay more bills. Therefore, setting up automatic payments will be a great habit to start as soon as possible. - Not having an emergency fund

Did you know that most people don’t have $400 to handle an emergency situation? If you have an issue with your vehicle or if you need extra money in a pinch, then you will want to make sure that you have an emergency fund.

One of the best ways to start an emergency fund is to begin to put away a little money each month. You can start by putting away as little as 2% of your monthly income into an emergency fund.

Usually, people will have some sort of financial emergency once every six months. Saving up six months worth of your money could easily give your hundreds or even thousands of dollars in emergency fund money.

Steps to managing your monthly bills

Now that you know the biggest mistakes that people make while managing money, it’s time to set up the ideal bill payment strategy. Here is the checklist of things that you should do each month.

- Download a finance app

- Gather your bills

- Set up automatic payments

- Save 2% of your money in an emergency fund

What can happen if you mismanage your bills

So what are the worst things that can happen if you don’t manage your bills. A little warning here - things can get a little ugly.

Your credit score could fall - You will want to maintain a credit score above 700 in order to get easy approvals on everything from apartment leases to car loans and mortgages.

You can get hit with multiple late fees - Late fees can range anywhere from $25 to $40 per missing payment deadline. Miss a couple of bills per month and you can end up losing $100 in late fees alone.

You could have your services cut off - Missing late payments can lead to disruptions of various services. That can cause a big headache in your everyday life.

You can get inundated with debt collector calls - If you miss enough of your payments, you bills can go into collections. That means that you can end up having to deal with multiple calls from debt collectors each day. You don’t want to deal with that in your life.

Stress - Financial issues are one of the leading causes of stress. You don’t want to spend all of your time thinking about money.

Staying on top of your monthly bills

Yes, it is possible to stay on top of your bills each month. Simply have a plan and use some sort of app or spreadsheets to keep track of your bills. Also be sure to dedicate some time each month you organize, pay and schedule your bill payments. With the right planning, your bills will be a breeze to deal with.